28+ House 28 mortgage calculator

How much house can I afford. An example would be if you had.

Premium Photo Calculator And House On Classic Blue Background Color 2020 Top View

To use our mortgage affordability calculator simply enter your and your partners income or your co-applicants income as well as your living costs and debt.

. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. What does that price difference mean to your. For example if the house you want to buy is 200000 and your mortgage amount is 150000 then your LTV is 75.

It can be hard to visualize the day-to-day financial impact between buying say a 400000 house and a 500000 house. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more.

Typically lenders cap the mortgage at 28 percent of your monthly income. Your debt-to-income ratio DTI should be 36 or less. Some loan programs place more emphasis on the back-end ratio than the front-end ratio.

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. A borrower should make sure he or she is able to pay the. Use our delightfully easy mortgage calculator.

This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. It states that a household. You can even.

These home affordability calculator results are based on your debt-to-income ratio DTI. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment. Follow the tried-and-true 2836 percent rule.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. Many financial advisors believe that you should not spend more than.

Which means you cant borrow more money until you. You can also try our how much house I can afford calculator if youre not sure how much money you should budget for a new home. Keep these factors in mind.

Her neighbor who has a house very similar to hers recently sold his house for 300000. Post A Rental Listing. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. First determine the annual mortgage insurance amount. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

Youll be required to pay PMI if your down payment is. The question isnt how much you could borrow but how much you should borrow. 300 25 years in 76296.

Do this by multiplying the loan amount by the mortgage insurance rate. How to use the mortgage affordability calculator. By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187.

This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage. Most lenders and calculators evaluate affordability with the 2836 rule which establishes that your housing expenses and total debt should not be more than 28 and 36 of your total pre-tax income respectively. Your annual mortgage insurance payment would be 1170.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Youll be required to pay PMI if your down payment is less than 20. Free house affordability calculator to estimate an affordable house price based on factors such as income debt down payment or simply budget.

What do you do. 225000 x 0052 1170. A 750000 house with a 5 interest rate for 30.

Get pre-approved for a mortgage. And Canada to determine each households risk for conventional loans. The best down.

Here if the remaining value of your loan was 225000 and the mortgage insurance rate was 0052 or 52 then. See how much house you can afford with our easy-to-use calculator. Your mortgage payment should be 28 or less.

The calculator does not include costs for private mortgage insurance. Industry standards suggest your total debt should be 36 of your income and your monthly mortgage payment should be 28 of your gross monthly income. Benefits of using our Reverse Mortgage.

With the profit that you sold your home you might be able to buy a smaller house with cash or a much smaller mortgage. That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation.

In this case she would enter all of this information and would receive a reverse mortgage estimate of 108495. She lives in a semi-detached home. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

Use our free mortgage calculator to estimate your monthly mortgage payments. What is the 2836 rule. How much house can you afford.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. Related Mortgage Calculator. Follow these steps before you use our home affordability calculator.

Reverse Mortgage Calculator How Much House Can I Afford HELOC Calculator HELOC Payment. The 2836 Rule is a commonly accepted guideline used in the US. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel.

Use our mortgage calculator to calculate how much you can borrow or try our mortgage repayment calculator to estimate your monthly repayments. A 65 year-old woman with no spouse lives in Halifax Nova Scotia. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home.

Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. A mortgage in itself is not a debt it is the lenders security for a debt.

![]()

Premium Photo 3d Icon Render Illustration Of Coins Stack Calculator And Home Financial Management Business Loans For Real Estate Concept Residential Finance Economy Home Property Investment Minimal Style

Coding For Kids Coding Preschool Lessons

50 Cozy Reading Nooks Cantinhos De Leitura Sala De Estar Marrom Cortinas De Sala De Estar

Premium Photo The Man Holds The House And Makes A Stop Gesture Bank Refusal To Provide A Mortgage Refusal To Provide Legally Guaranteed Housing Confiscation Pledged Property Denial Of Insurance Payment

Pin On Next House

Outdoor Kitchens This Ain T My Dad S Backyard Grill Outdoor Kitchen Outdoor Kitchen Cabinets Outdoor Kitchen Appliances

Premium Photo House Coins And Money Bags On Pink Background Property Investment Real Estate Business Concept Home Purchase And Fund Minimal Cartoon 3d Rendering Illustration

14 Best Ways To Save For A House Hanfincal Com

4 Tier Ladder Bookshelf Storage Display With 2 Drawers Ladder Bookshelf Bookshelf Storage Bookcase Storage

For Sale 10327 Starrs Road Arcadia Nova Scotia B0w1b0 202214274 Realtor Ca

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

306 Burke Drive Mattawan On P0h 1v0 For Sale Re Max 40309673

For Sale 10327 Starrs Road Arcadia Nova Scotia B0w1b0 202214274 Realtor Ca

Product Roadmap Powerpoint Template 9 Powerpoint Powerpoint Design Powerpoint Templates

Collateralized Mortgageobligation Advantages And Disadvantages

Pin On T I P S I D E A S

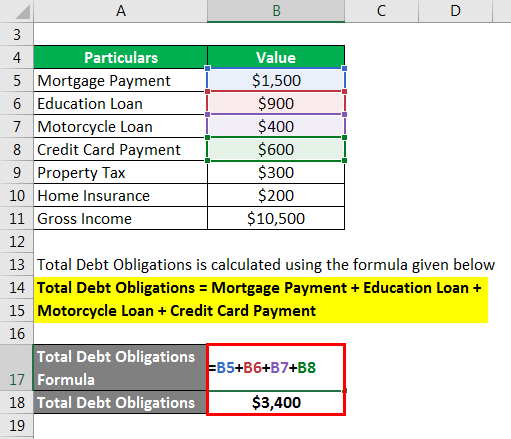

Total Debt Service Ratio Explanation And Examples With Excel Template